How healthy is the UK manufacturing market?

The first two quarters of 2023 revealed recovery indicators with UK and export balances remaining steady. This is because prices have lowered since the peak, but are still quite high in comparison to previous annual results.

Over the summer of 2023, industry insiders started to warn that with service sector and manufacturing output reductions, the risk of recession was growing stronger. A pressurised economic landscape, due in part to the cost of living crisis and higher interest rates, is tightening consumer demand and spending.

This uncertain trading environment is also reflected in current industry data. The UK Composite Output Index displayed a rate of 46.8 in September 2023, down from 48.6 in August, demonstrating the steepest reduction in output since the pandemic lockdown of January 2021.

How is the UK economy affecting road transportation?

It’s an accepted truth that manufacturing and logistics are natural partners. A key UK manufacturing trade body, Make UK, recently said we should expect UK manufacturing output to fall 0.5% in 2023 and is predicting a similar rate throughout 2024, which could also present further challenges for transportation.

Significant economic headwinds are constraining the UK economy, namely acute inflation, living costs and soaring energy prices. Additionally, changes in trading conditions created by Brexit and an industry drive towards decarbonisation are also adding to this tough environment.

However, David Wells OBE, Chief Executive of Logistics UK, recently said that:

“Logistics underpins the whole economy and by putting logistics first, with the right partnerships, regulations and investment, government can supercharge the UK.”

Legal changes affecting the UK transportation market

The legal landscape in the UK has significant influence over the present state of the transportation sector. In fact, UK government legislation has just been updated to introduce longer lorries on British roads from 31st May 2023, with the aim of reducing road emissions and strengthening supply chains.

UK government publications show that the longer lorries could possibly tally 8% fewer journeys than current goods vehicles. Government departments are expecting a £1.4 billion uptick in economic activity as a result of these changes.

Transportation has undergone a series of changes since the legal frameworks of Brexit came into force. From October 2021, companies have been required to make safety and security declarations for most of the consignments leaving or entering Great Britain, increasing overall costs.

Furthermore, the HGV road user levy was reintroduced on 1st August 2023, applying an amended rate structure on UK registered and non-UK registered goods vehicles. Fees will be based on vehicle weight, air quality emission standard, and levy duration.

Alterations to IT systems are also taking place. Logistics companies may need to be aware of the EU Entry/Exit System (EES), the new border control IT system going live at the end of 2023. The EES will require all non-EU nationals, including British truck drivers, to register biometric details. Plus, it may require truck drivers to leave their cabs to register, creating possible delays in travel and delivery timings.

Importers and exporters are also being told to prepare for the new 2023 EU-UK Sanitary and Phytosanitary controls that will apply towards the end of 2023. The controls include the need for checks and export certificates for products of animal origin, animal by-products and high-risk food, amongst other categories.

Popular destinations for British carriers

The most popular road transportation destinations for UK hauliers have not varied in recent times, despite the substantial shifts in legal and economic circumstances. 3.1 million tonnes of goods were exported from the UK using UK-registered vehicles in 2022. Some may find it surprising to learn that 90% of this total was unloaded in just 5 countries:

- 👉 France: 1.08 million tonnes

- 👉 Belgium: 0.68 million tonnes

- 👉 Ireland: 0.51 million tonnes

- 👉 Netherlands: 0.35 million tonnes

- 👉 Germany: 0.20 million tonnes

These top five export countries have remained consistent for the UK over the last two decades. In terms of imports from these countries, we saw 3.5 million tonnes brought into the UK by UK-registered goods vehicles during the same time period.

Domestic market landscape 2023

In terms of fluctuation, it would appear the domestic transportation market has been reliably stable. Analysis of the British domestic market reveals that there was a steady rate of goods lifted and moved during 2022, with no more than 3% variation from quarter to quarter.

In line with these statistics, distances travelled by domestic goods transportation vehicles remained relatively static over 2022, although there is evidence of a slight dip in Q2 2022, recovering in the festive period up to Christmas 2022.

However, domestic goods carriers face the same challenges that are affecting all areas of trade: the negative impacts of the cost of living, inflationary pressures, supply chain issues and high fuel prices. Even though we are seeing some reduction in these areas, pre-pandemic levels have not yet been achieved.

Transportation vehicle demand

Since our break with the European Union, there has been much discussion over the future of the UK’s vehicle industry. Bearing good news, the Society of Motor Manufacturers and Traders (SMMT) reports that Britain’s light commercial vehicles (LCV) market grew 44.2% in July 2023, with electric van demand almost doubling, up by 94.6% in June 2023.

Recent data is also pointing to an uplift in HGV registrations, with an increase of 7.5% between July 2022 – July 2023. Across the board, demand for goods vehicles has grown month on month since the end of 2022. It would seem that these increases demonstrate a regeneration in the logistics sector, with growth continuing into autumn 2023.

What to expect next in the transportation market

The UK road transportation market is the valuable arterial network we rely on to keep the UK moving. As the shift towards a more sustainable and ecologically-friendly logistics sector continues to evolve, hopes are that these will seamlessly align with government legislation and industry targets around net zero for 2050.

Automation in warehouses is expected to increase over the next decade, with manufacturing and logistics systems concentrating investments on automation technology that supports fast delivery solutions.

Logistic companies are likely to maximise the potential of collaborations with digital platforms to enhance efficiencies and cost saving programmes. Industry insiders predict that the global digital logistics market could be worth $46.5 billion by 2025.

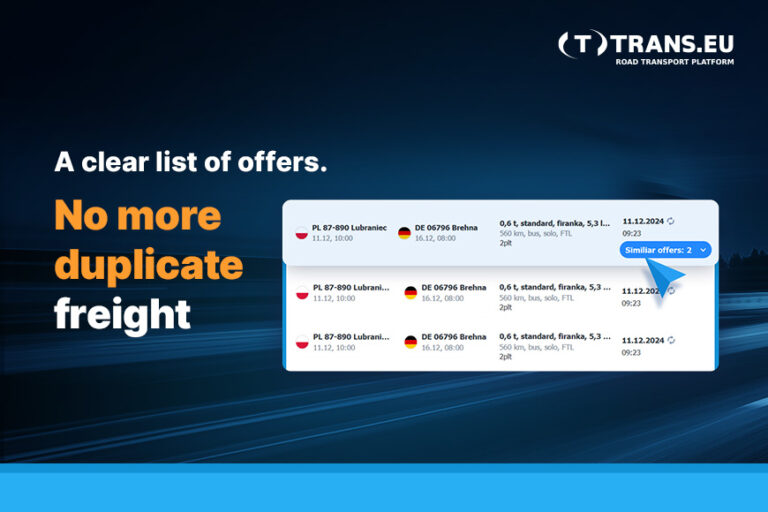

Digital logistics platforms support with cost-effective products and streamlined supply chain solutions. These assets help to ensure that customer satisfaction levels are met or exceeded, alongside efficiencies across the entire logistic journey.

How Trans.eu makes all the difference

Trans.eu is the easy, simple and effective way to find the loads you need, and work with trusted companies that get you moving on time. With thousands of loads and verified contractors at your fingertips, in a few clicks you’ll secure personalised offers that are precision-led and tailored to your needs.

There are powerful benefits when you choose Trans.eu:

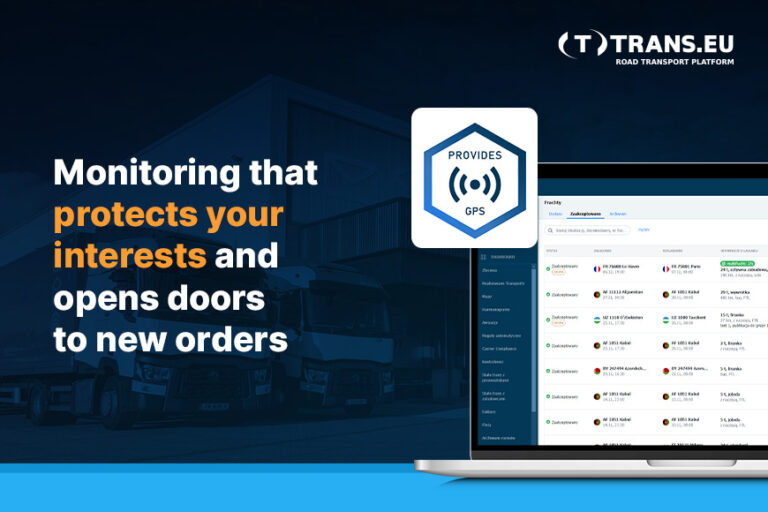

✅ Security of cooperation

You only work with reliable companies, verified shippers and forwarders, awarded user-friendly ratings for complete peace of mind.

✅ Loads at the touch of a button

Never miss the right load for your needs with our Loads2Go! mobile app, giving you full platform access 24/7 to help you effortlessly negotiate rates.

✅ Quick, reliable negotiation turnaround

Our Messenger communication platform enables you to talk directly with the ordering party for speedy resolutions. Set freight price, currency and use the automatic translation option to wrap up the whole process.

✅ Customised needs, fleet and routes

Pick loads of any truck body, from anywhere across the UK and Europe directly from shippers and 12,000 forwarders. Load, reload and return with ease in your chosen timeframe.

To help you find the exact solution you need, Trans.eu can offer you over 87,000 offers per year. If you’re looking for more compact transportation, we deliver over 12,000 offers per year on transport under 1.2T.

Empowering you with more simplified and reliable solutions, we supplied over 2 million freight offers on the most popular cabotage routes in Q3 of 2023, including Germany, Belgium, the Netherlands, France and Italy.

Want to secure the premium loads and carriers in the most simple and efficient way possible? Trans.eu helps to get you moving.

Get in contact to find out more.