Key takeaways

- ✅ Industry in the countries of the European Union remains weak, but it is slowly recovering from the recession. The European Commission’s so-called spring forecast predicts GDP growth in 2024 to be 1.0% in the EU and 0.8% in the eurozone.

- ✅ More and more vehicles are disappearing from the transport market, which causes an increase in rates on the most scarce routes. According to carriers, however, this is a very slow process.

- ✅ The number of shipments to the United Kingdom is increasing again, after a period of stagnation related to the introduction of customs and administrative restrictions. A significant obstacle there is the prohibition of cabotage shipments without a load. The entrepreneur must also have an EORI (Economic Operator Registration and Identification) number, needed to carry out commercial transactions between the United Kingdom and EU countries.

- ✅ Cabotage transport in Germany is still one of the most attractive offers for transport companies from Central and Eastern Europe. German carriers cannot withstand such competition in terms of price.

- ✅ In order to save margins, carriers are also looking for alternative markets, also outside the EU. They are more likely to go to Italy, Spain, Austria or Switzerland.

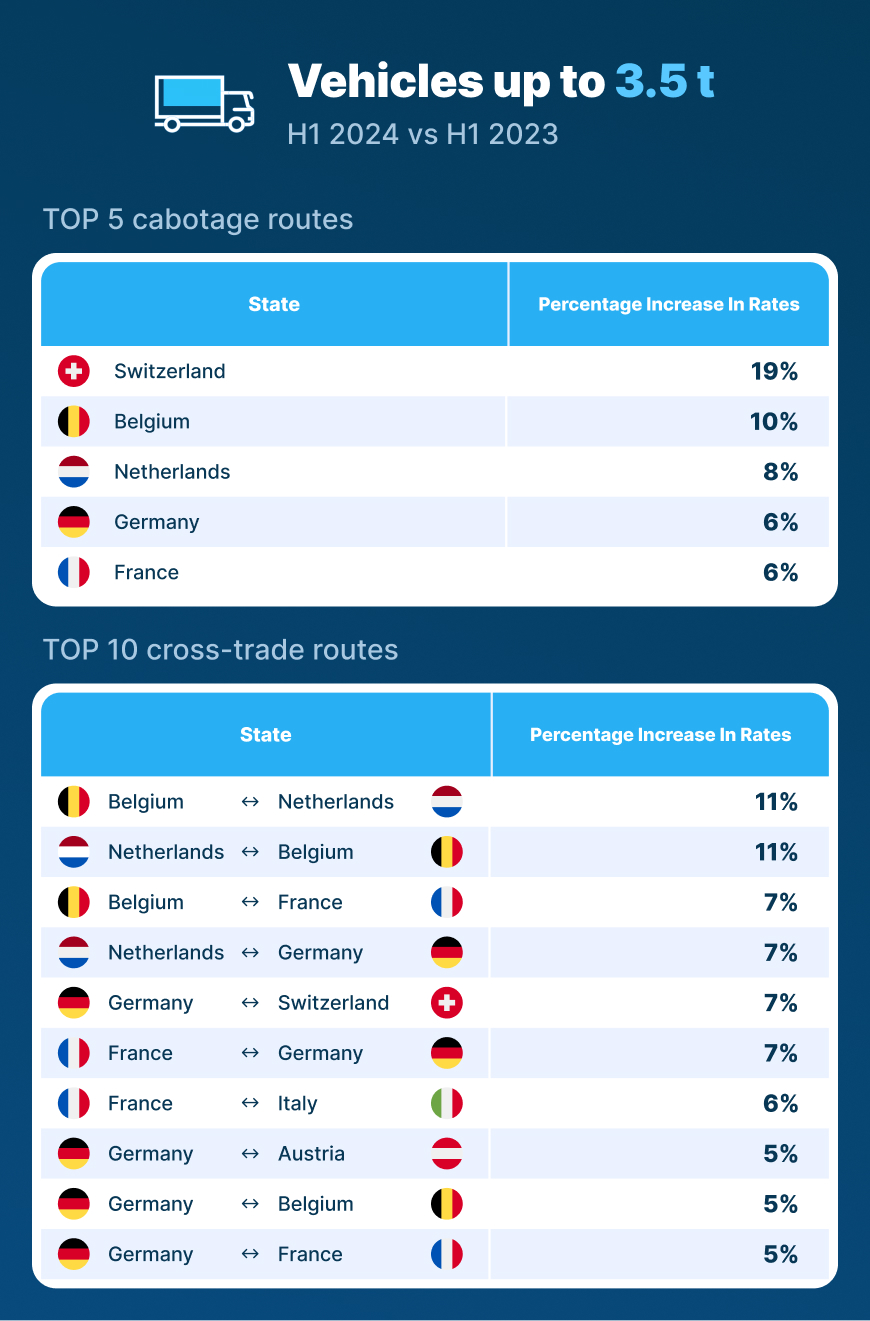

- ✅ On some routes, the rates for vans are increasing (3.5t GVW), which may be partly due to the lack of available trucks, but also to greater flexibility in this category of vehicles. Until the end of June 2026, vans running on international routes do not need to be equipped with tachographs, and drivers are not subject to working time restrictions.

Summary. Key findings from the market analysis.

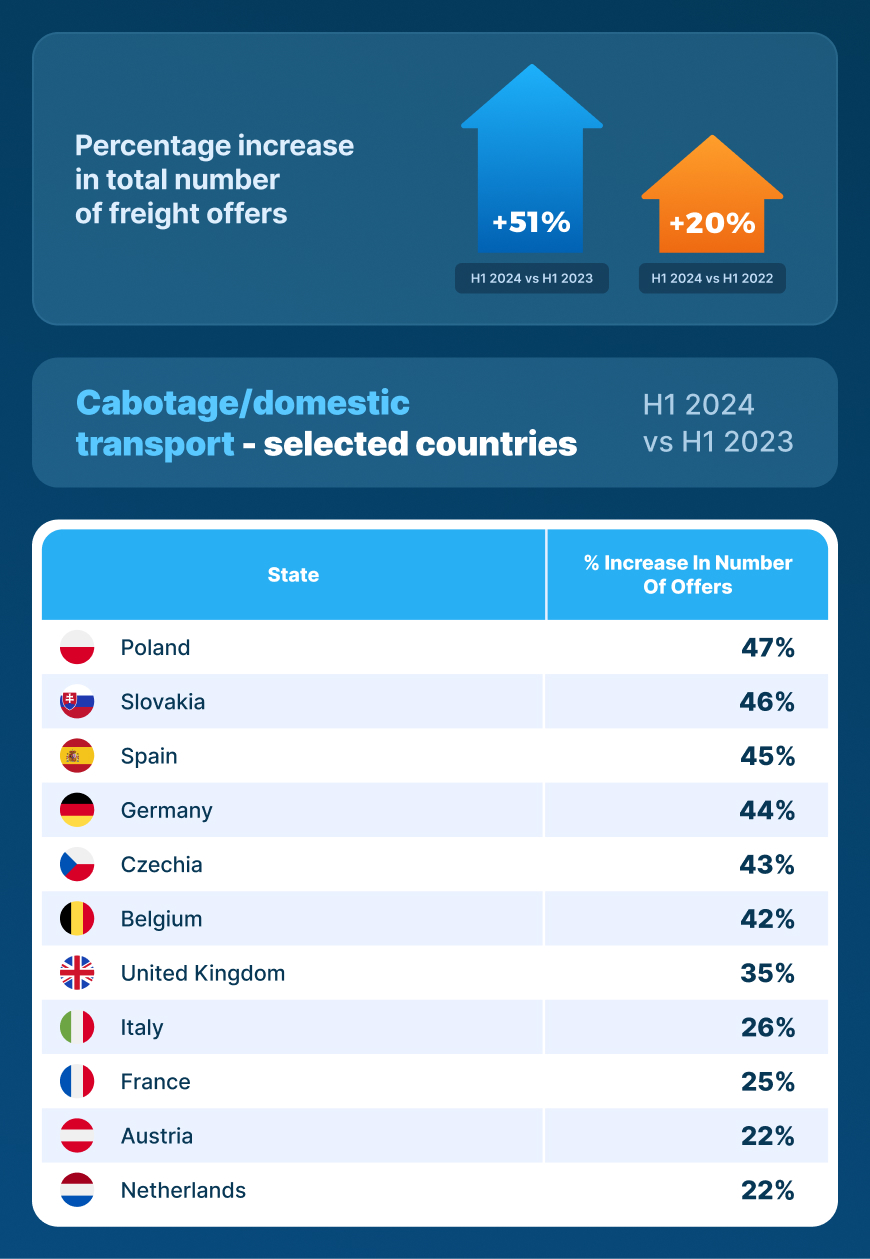

- ✅ There is a clear increase in the number of offers: 51% compared to the first half of 2023 and 20% in relation to the first half of 2022. This information suggests a slow stabilization in the market.

- ✅ Despite the slowdown in many sectors of the economy, there was a clear recovery in trade in goods with Germany (a significant increase in the number of offers and rates), which continue to be a driving force in Europe.

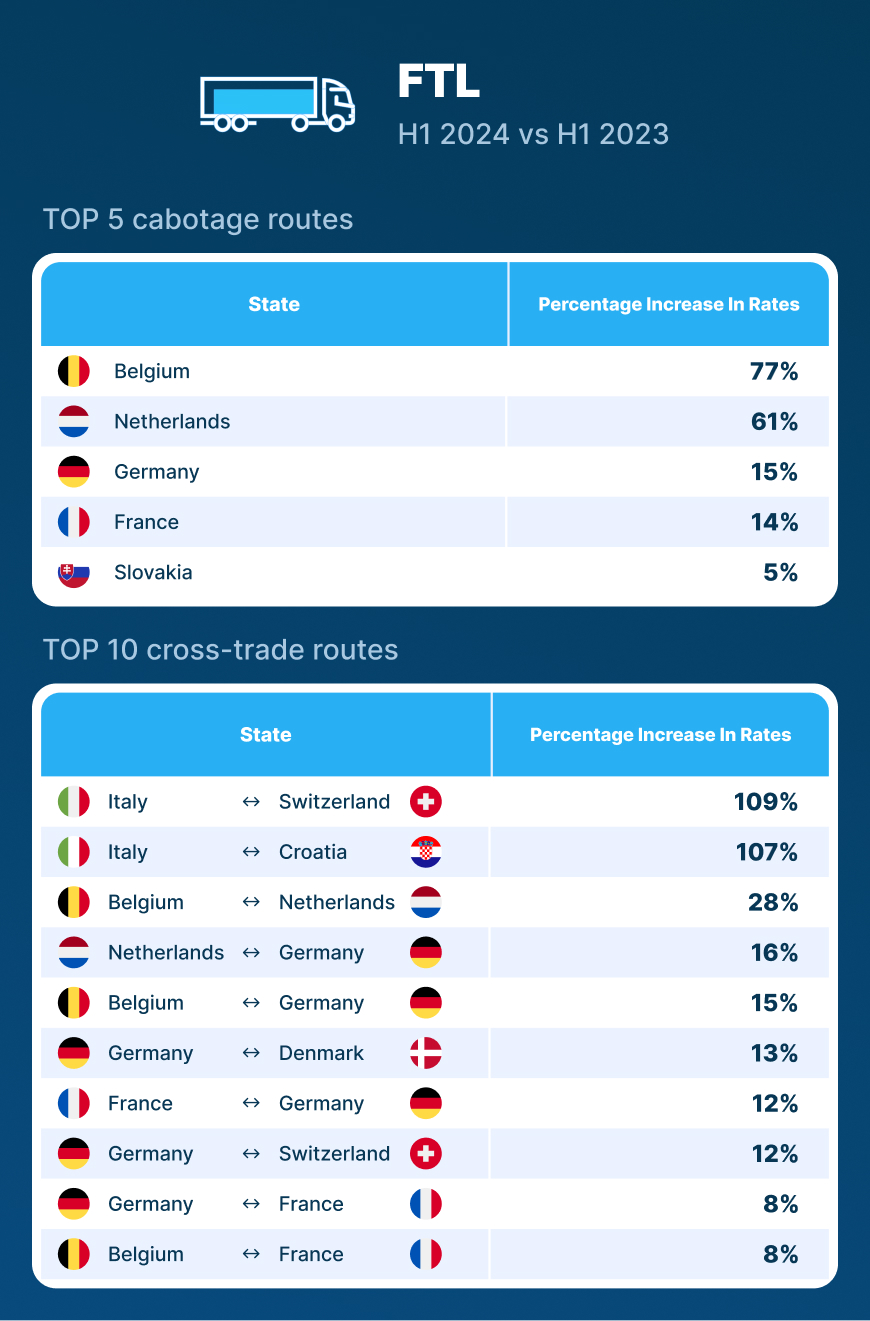

- ✅ For vans and FTL, Germany, the Netherlands, Belgium and France remain key areas of operation.

- ✅ A significant increase in the volume of transported loads in the trade of goods in bilateral transport was recorded by the Czech Republic (return transport – from and to the Czech Republic).

- ✅ Outside the EU zone, the situation in the British direction has stabilized, there is also a greater

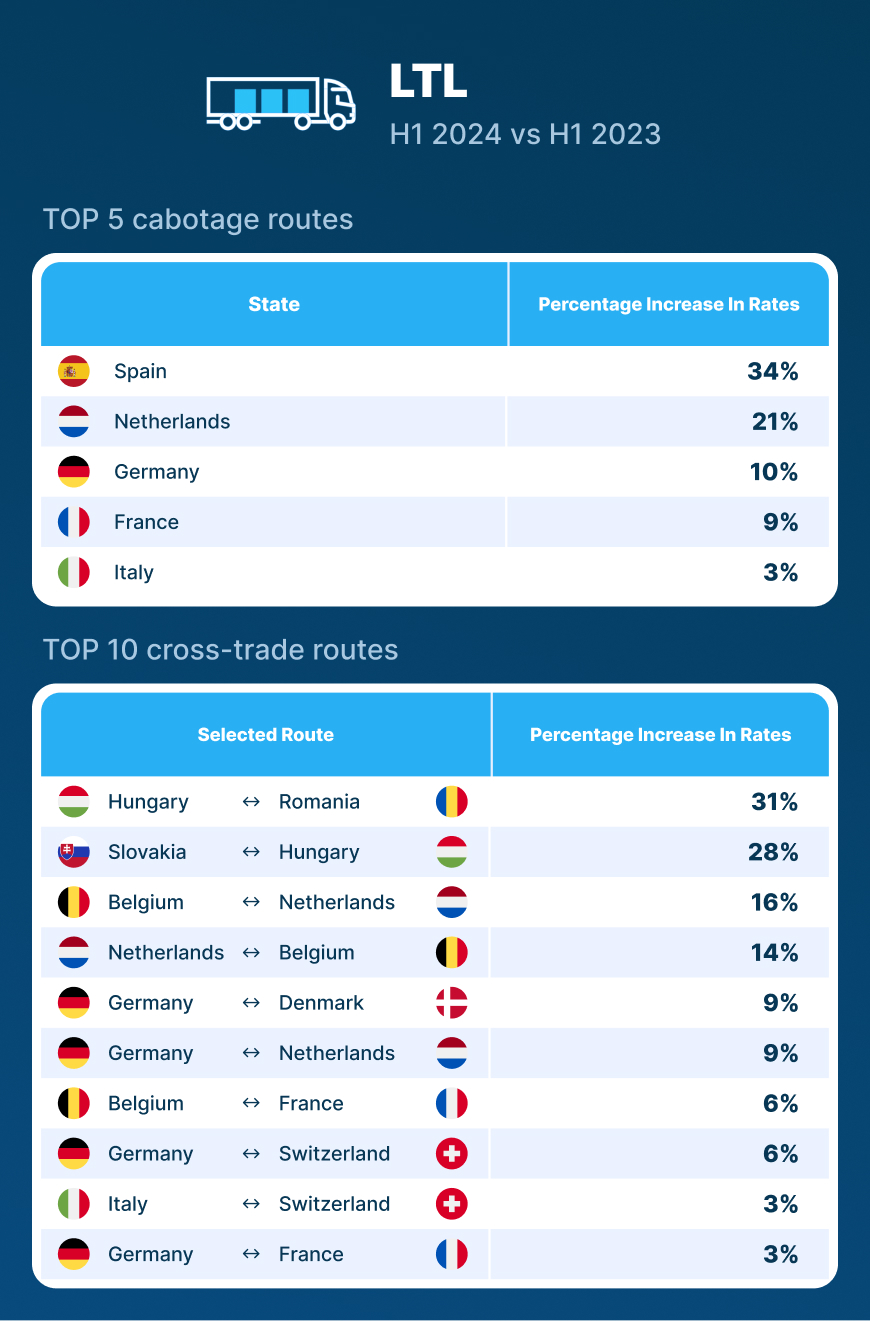

interest in routes to Switzerland, which is due to higher rates in this direction. - ✅ Median rates for vehicles up to 3.5t GVW on key cabotage routes (Austria, Belgium, Czech Republic, France, Germany, Hungary, Netherlands, Spain, Switzerland) is higher than in bilateral transport from the countries listed. In turn, we can observe a decrease in prices in LTL and FTL cabotage.

- ✅ Increase in the number of offers and cabotage transports for vehicles up to 3.5t GVW coincides with weaker performance in cross-trade transport.

- ✅ Hungary – a significant increase in the number of offers in bilateral transport, especially FTL. Slovakia – a clear increase in the number of offers in cross-trade transport.

To read more about this topic and see industry experts opinions go to: Growth in European road transport 2024. Market analysis and forecasts