Top road transport destinations in Europe (infographic)

First, a basic conclusion: international freight is generally on the rise. Such a trend in bilateral, cross-trade and cabotage transport is evident on most European truck routes. All the attention of the sector is focused on the situation in Germany, until recently the economic locomotive of the continent, and for two years now the “sick man of Europe”.

Germany is waking up

Meanwhile, the PMI Index, which is a barometer of the mood among managers in key sectors of the economy, is slowly but steadily growing in Germany. According to the data for the last quarter, the German manufacturing PMI index reached 42.2 points. While it is still far from the magic 50-point level that marks the transition from economic stagnation to growth, economists are relieved by the latest data.

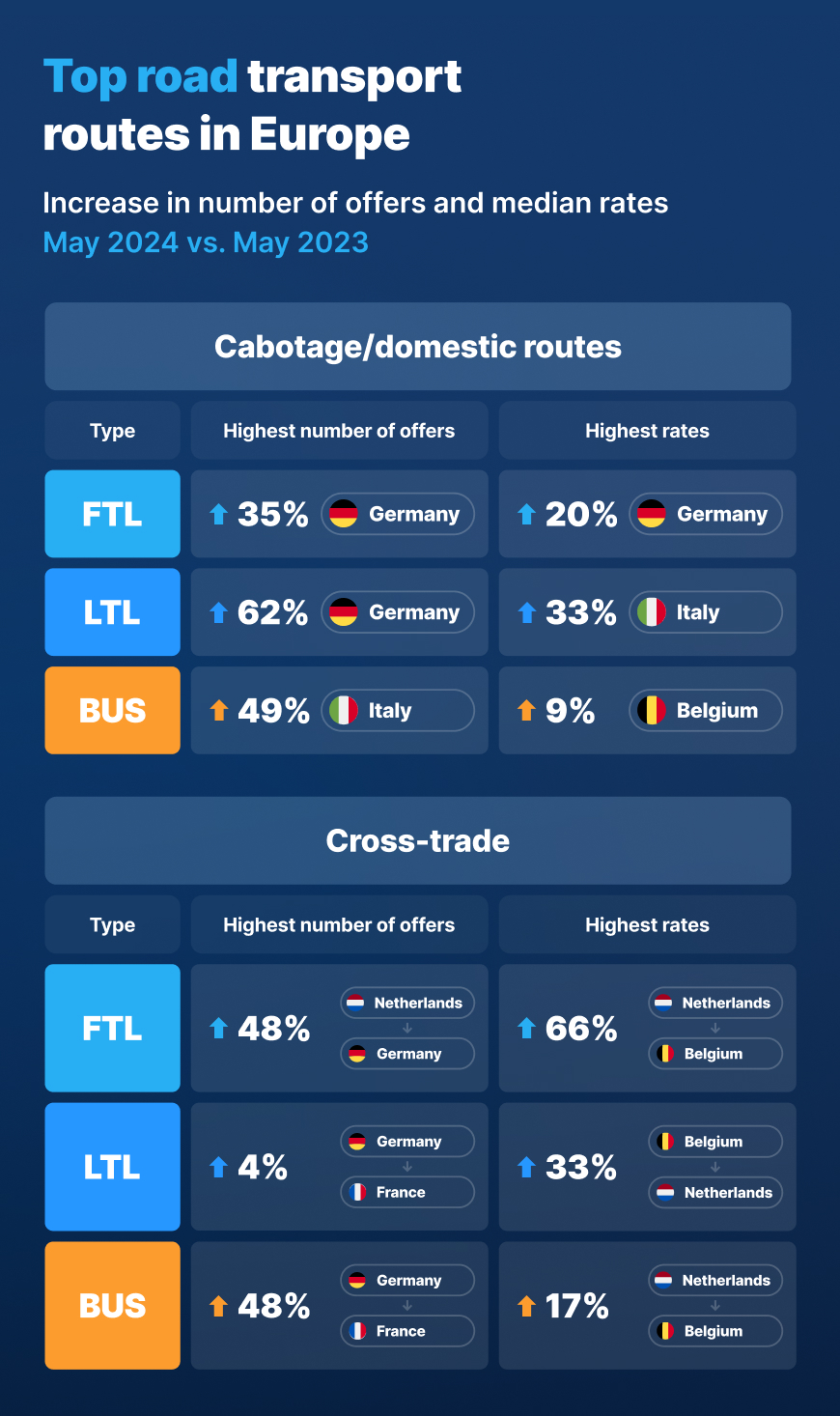

Germany’s economic recovery is also confirmed by statistical data. The local market dominates in Europe in terms of the number of cabotage transports. In May 2024, the number of full truckload (FTL) and less-than-truckload (LTL) shipments increased significantly compared to the same month last year. For the latter, the increase in the number of offers was as high as 62.3%.

For cross trade, the most popular truck routes in Europe are also related to the German market. (Though it is obviously not the only attractive route in the EU). The popularity of the route from the Netherlands to Germany increased by 48% compared to the previous year, and from Belgium to Germany by as much as 69%. Belgium and the Netherlands are of great interest to carriers in all modes of transport and, for example, in the bus segment, both countries are at the forefront of prices (cabotage price increased by 8.9% in Belgium and by 10.8% in the Netherlands).

More traffic in ports

What makes Benelux so popular among carriers? “Traffic is increasing at the seaport of Antwerp, which is a universal port that handles all types of cargo. Together with the Dutch port of Rotterdam, they currently handle the most cargo in Europe. Therefore, this increased traffic must be handled by larger transport. The routes from the Netherlands also involve the seasonal export of vegetables, in which the Dutch are world leaders,” says Beniamin Matecki, T&L market consultant. (The Netherlands produces a lot of onions, beets, root vegetables, Brussels sprouts and tomatoes).

The improving economic situation in the Euro zone is also reflected in the increasing number of offers in the spot transportation market. The European Commission’s recently published Spring Economic Forecast is cautiously optimistic. GDP growth in 2024 will be around 1% across the European Union and 0.8% in the Euro zone. Inflation is also declining rapidly and is projected to fall from 6.4% in 2023 to 2.7% in 2024 as measured by the HICP.

“The EU economy recorded strong growth in the first quarter, indicating that we have managed to bounce back after a very difficult 2023. We expect a gradual acceleration of the growth rate this year and next. This growth is driven by private consumption, which is supported by falling inflation, as well as improving purchasing power and sustained employment growth,” says Paolo Gentiloni, EU Commissioner for Economy.

France getting more popular

The analysis of data from the Trans.eu Platform also shows that France and Italy were again among the most popular truck routes. France, together with Germany, is one of the European leaders in cabotage (both the number of offers and the level of rates are increasing). The same can be said for cross-trade, where the increase in offers on the Germany-France (LTL) route amounted to 18.7%, which could indicate a clear recovery for this not-so-long-ago popular route.

However, experts point out that economic growth in a given country does not always go hand in hand with the popularity of transport. “Slovenia, Portugal and Cyprus have the best economic situation. However, it is difficult to imagine that transport from these countries could be an attractive alternative to carriers serving the German economy, for example. The French and Spanish economies, which are in better shape, are much larger than the markets of the three countries mentioned. And more attractive. However, it should be added that these markets are more difficult for carriers from Central and Eastern Europe due to their specificities” says Maciej Wroński, President of the Employers’ Association Transport i Logistyka Polska.

Competition from Ukraine

Representatives of the T&L industry organizations agree: The cross-trade and cabotage situation has been destabilized by unfair competition from Ukraine. This has mainly affected Poland, the largest European carrier (about 20% market share), but also companies from Lithuania, Bulgaria and Romania, for which international transport is quantitatively larger than domestic transport.

But the most important information for carriers concerns macroeconomic data. For it is these data that indicate that Europe is slowly returning to the path of economic growth. This is followed by an increase in the number of transports. According to the latest report from S&P Global and Hamburg Commercial Bank, the combined manufacturing and services PMI reached 52.3 points in May, the highest level in twelve months. On the other hand, the European road transport market is expected to grow by 1.7% in 2024, according to forecasts by the research agency Transport Intelligence. The situation in Germany remains key, but carriers have not stopped driving there. “Cross-trade and cabotage operations related to the German market have not lost their popularity. This fact is indirectly confirmed by the situation in the digital tachograph market, where carriers are increasingly limiting themselves to purchasing new recorders and postponing their installation. They probably do not want to register the actual number of transports,” believes Maciej Wroński.